45L Energy Efficient Tax Credit

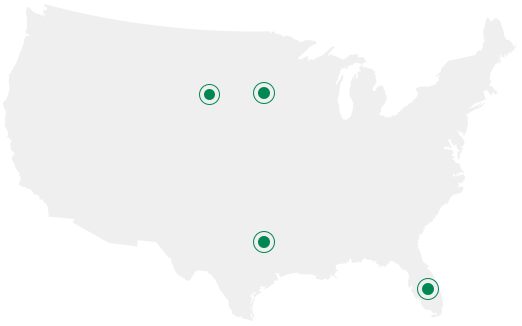

Builders can take advantage of the 45L Energy Efficient Home Tax Credit with Johnson Environmental LLC.

The 45L New Energy Efficient Home Tax Credit provides generous incentives for builders and developers. It offers a federal tax credit of up to $2,000 for each dwelling unit that meets the specified energy efficiency requirements after December 31, 2005. Through the Inflation Reduction Act, this amount may increase to as much as $5,000 per unit in 2023. This also changes the eligibility criteria for residential developments, with all now qualifying, whereas prior, only low-rise residential developments were permitted. Johnson Environmental LLC is a certified HERS inspector that can evaluate your property to see if it is eligible for the 45L energy-efficient tax credit.

What developments can take advantage of the 45L Tax Credit?

The 45L Tax Credit applies to a number of residential projects such as single-family homes, apartments, and condominiums of up to three stories above ground level, ADUs, assisted living facilities, and student housing. These dwellings must meet certain energy standards in order to qualify for the credits. With construction trends leaning towards greater energy efficiency and local building codes becoming more stringent, many developments can now easily fulfill eligibility requirements for the tax credit. As a HERS inspector Johnson Environmental LLC can evaluate your property to see if it meets the requirements for the 45L tax credit.

FAQs

Does Johnson Environmental help builders qualify for the 45L tax credit?

Yes, we are certified to conduct all assessments required for the 45L tax credit.

How do I Qualify for the 45L Tax Credit?

To be eligible for the 45L Tax Credit, units need to exceed a 50% efficiency threshold compared to the 2006 IECC. This must be certified by an approved certifier and completed with a closed escrow by December 31st of the tax year. Improvements in the building envelope must provide at least one-fifth of the energy reduction needed. Additionally, all buildings which are three stories or less in height and qualify as a residence may be entitled to this credit – which can also be taken retroactively up to three tax years prior. The credit applies to single-family homes, condos and apartment complexes, assisted living facilities, and student housing. Each living unit within a multifamily residential facility may also qualify.

How do I receive the 45L tax credit certificate for my building?

For a free tax credit consultation, contact Johnson Environmental LLC, a certified HERS inspector. Each home will go through the Energy Pro v4.8 certification process. If your building meets the recommended requirements, you will receive a 45L tax credit certificate.

Does claiming the 45L tax credit have any downsides?

No. In the long run, energy-efficient building materials are more than worth it, even if they cost more because of the tax credit and the increased equity and utility savings. A tax credit is intended to encourage builders to use energy-efficient materials and homeowners to build with energy-efficient materials.

Can previous years’ projects qualify for this tax credit?

Generally, tax filings can be amended up to three (3) years after the date of filing.

See if Your Project Qualifies

If you are a builder or developer constructing energy-efficient residential buildings, call Johnson Environmental LLC the certified HERS inspector. Contact us at (605) 940-0759 to see if your project qualifies for the 45L Energy Efficient Home Tax Credit.